The Eruption of Techno-Feudalism: AI, Economic Upheaval, and the Coming Political Reckoning

Modern Political Ideology Part 4

The Eruption of Techno-Feudalism: AI, Economic Upheaval, and the Coming Political Reckoning

On a quiet morning in early 2025, the Kīlauea volcano in Hawaii awoke with violent precision. Scientists at the Hawaiian Volcano Observatory had been tracking subtle inflationary shifts in the magma chambers for months—underground pressure steadily rising, pushing against the volcanic rock. Then, almost overnight, the inflation reached a critical threshold. The rock fractured. The eruption began.

Within days, what had once been a slow-building inflationary process transformed into a spectacle of deflationary destruction. Molten rock surged from fissures, displacing everything in its path. Entire landscapes were reshaped in real-time—what had once been stable ground was now a river of fire, carving a new topography that had no regard for the past.

This dynamic—inflation followed by sudden deflation—mirrors what is about to happen to the American economy under corporate techno-feudalism. The inflation of wealth and power among AI-driven monopolies has been building for decades, fueled by Silicon Valley venture capital, deregulated financial structures, and an economic model that prioritizes corporate efficiency over labor security. But now, just like Kīlauea’s magma chambers, the system is primed to rupture.

Inflationary pressure in the corporate economy has rewarded monopolization, automation, and rent-seeking, allowing tech giants to consolidate unprecedented power.

The deflationary collapse is coming for workers—where entire job sectors will erupt in a wave of automation-driven obsolescence. White-collar professionals, once thought to be immune to technological displacement, are standing on unstable ground without realizing it.

The intermediary, the enabler, the gatekeeper, the conduit (or whatever appropriate term you wish to use) is none other than the U.S. Federal Government with its Fed/Treasury controlled balance sheet that oversees a gargantuan debt and deficit fiscal and monetary lava machine.

In Part 3, we introduced the concept of corporate techno-feudalism, where Big Tech and financial oligarchs extract wealth not through traditional market competition, but by controlling the digital and economic infrastructure that businesses, workers, and consumers must rent to stay in the game.

Now, in this fourth essay, we turn our focus to how this economic eruption will reshape America.

The upcoming crisis isn’t just about job losses—it’s about who owns the future of productivity and innovation. It’s about whether AI will enrich the many or further entrench the power of the few. And, perhaps most consequentially, it’s about how President Trump’s economic nationalism is about to collide with the brutal efficiency of AI-driven dark capitalism—pitting government-led interventionism against an automated productivity war that mostly benefits the largest corporate players.

The pressure is building. The fissures are forming. The economy, like Kīlauea before its latest eruption, is nearing its breaking point.

I. The AI Disruption and the End of White-Collar Job Security

The industrial automation wave supported by the global neoliberalism of the late 20th century devastated manufacturing jobs in the United States. The next great labor disruption is targeting white-collar professionals, from accountants to paralegals, software engineers, and even financial analysts.

AI as the New Labor Disruptor

Unlike previous waves of automation that replaced physical labor, artificial intelligence (AI) replaces cognitive labor. Systems like ChatGPT, Claude, Gemini, MidJourney, GitHub Copilot, and AI-powered legal assistants are accelerating the obsolescence of once-secure professional fields.

According to a Goldman Sachs report in 2023, up to 300 million jobs globally could be affected by AI, with white-collar jobs facing the greatest risk. The key areas of impact include:

Finance & Accounting: AI models now perform risk analysis, fraud detection, and even tax preparation more efficiently than human workers.

Software Engineering: Low-level coding and debugging are being automated by AI-powered tools, threatening entry-level tech jobs.

Law & Legal Research: AI-driven contract analysis and case law research are making junior legal positions redundant.

Healthcare Administration: AI can handle billing, insurance processing, and diagnostic triage, further reducing white-collar employment in hospitals and insurance firms.

From Wage Labor to Algorithmic Dependence

Corporate techno-feudalism thrives when workers are forced into digital dependencies. Instead of job stability, professionals are being funneled into temporary gig work, subscription-based tools, and data-driven HR systems.

The emerging AI economy does not create new middle-class opportunities—it creates new forms of digital serfdom, where workers:

Rent access to AI tools rather than build careers.

Compete against algorithmic optimization that renders their skills redundant.

Have their productivity data harvested and monetized by AI-powered HR systems.

Instead of ushering in a new era of productivity-led prosperity, AI is enabling massive labor disruption without the counterbalance of commensurate job creation.

AI to Revolutionize Knowledge Work

The popular substack, Doug Casey’s Crisis Investing, recently took a positive spin on the AI disruption. Podcaster Matt Smith lays out some fascinating examples of AI in a February 13, 2025 note entitled: AI, Energy, and the Future of Abundance.

Even now, AI tools are already transforming white-collar industries, helping companies and professionals get more done with fewer resources.

JPMorgan’s AI system, COIN (Contract Intelligence), can process 12,000 commercial loan agreements in seconds—a job that would take humans roughly 360,000 hours a year.

Morgan Stanley rolled out an AI assistant called “Debrief” for its 15,000 wealth advisors. It handles note-taking and meeting summaries, saving about 30 minutes per meeting. With around 1 million Zoom calls a year, that adds up to 500,000 hours saved annually.

Companies using AI for their marketing strategies have seen response rates jump by 40% while cutting deployment costs by 25%.

At Goldman Sachs, AI can now draft 95% of an IPO prospectus in minutes—a job that used to take a 6-person team weeks to complete.

Mark Zuckerberg, on a recent Joe Rogan podcast, said that this year—2025—Meta will have an AI that works like a “mid-level engineer writing code.” To give you an idea of the savings, Meta has 15,000 mid- and low-level software engineers making $175,000 to $260,000 a year.

White-Collar Job Impacts By the Numbers

An examination of major labor categories in the annual reporting from the U.S. Bureau of Labor Statistics yields some high-level assumptions about the potential knowledge-worker displacement by AI. The following table presents five key labor sectors where potential job cuts of 5% to 20% might be anticipated over a 3-5 year period with mass deployment of AI agents in the workforce.

Combining the impacts of layoffs that might hit Information, Financial activities, Professional and business services, Health care and social assistance, and Public administration, we see the potential for somewhere between 3.3 to 13.2 million job cuts. The unemployment rate could be adjusted upward by 2 to 8.2%.

If these numbers were to come in around the midpoint, the U.S. economy would see 8 million job losses from rapid AI deployment and a 5% increase in unemployment, bringing total unemployment to about 9%. That would amount to about $800 billion in lost wages and another $240 billion in lost employment benefits. Of course, some of that tab would be picked up by government unemployment insurance.

According to Lau Vegys on Substack:

White-collar jobs have been contracting for 17 straight months. That’s the longest streak since the 2008 financial crisis.

And when you do the math, the U.S. has lost 240,000 white-collar jobs since February 2023.1

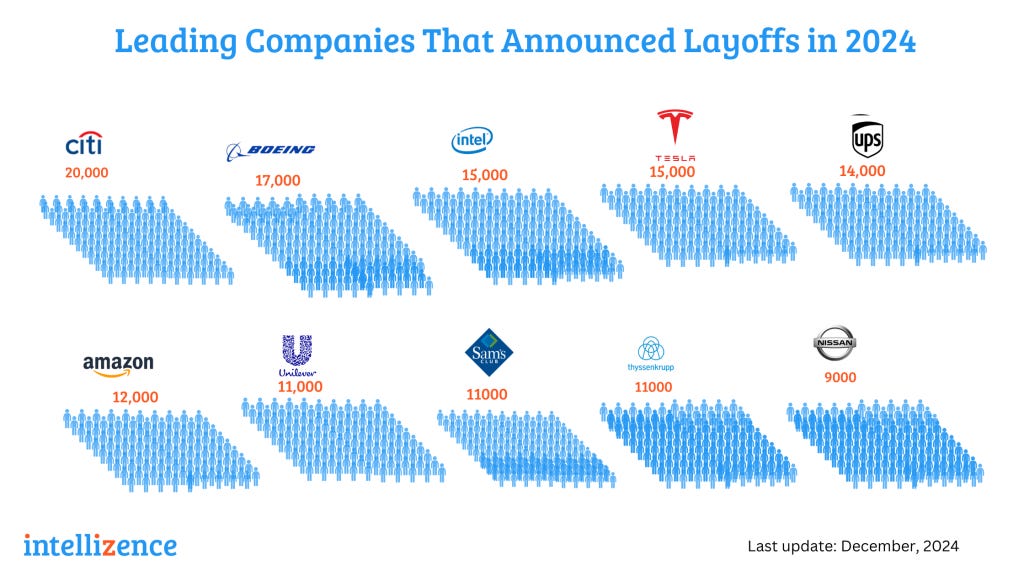

It’s already begun. And how about the the major layoff announcements in the past twelve months? The list has plenty of tech, finance, retail, and services companies.

And don’t forget DOGE! The federal government is shedding jobs at the fastest pace in recent memory.

II. The Trump 2.0 Economy: Productivity Wars Instead of Growth

With President Donald J. Trump having returned to the White House, his economic strategy will determine how the United States handles this AI shift. But instead of reviving economic dynamism, his policies could accelerate a corporate war over productivity that entrenches techno-feudalism even further.

Trump’s Likely Economic Playbook

Trump’s economic vision, based on tariffs, corporate tax cuts, and deregulation, will do little to expand real wages or economic opportunity. His priorities will likely include:

Massive deregulation to give Big Tech and financial firms even more power to restructure labor markets. Deregulation will allow companies to cut workers that mostly serve the need for compliance.

A renewed focus on industrial policy, but one that rewards mega-corporations rather than small businesses. While new nationalistic industrial policy may revive manufacturing capacity, it’s unclear what portion of activity will support new jobs vs. new robots.

An aggressive productivity push, where automation and AI efficiency gains are prioritized over employment growth.

Economic Starting Conditions Are Not Good

Trump is inheriting the fruits of Bidenomics. Bidenomics is the term used to describe President Joe Biden’s economic policies, which focused on rebuilding the American middle class, increasing economic competitiveness, and addressing long-standing inequalities. The approach was characterized by a mix of industrial policy, labor empowerment, and government investment in infrastructure and innovation.

However, the government tab is overextended and the benefits of industrial policy were not widely felt, or they were spent on policy boondoggles (i.e. a wasteful or impractical project or activity often involving graft, like EV school busses that don’t work in the winter). Most importantly, the heavy infrastructure and industrial push fueled inflation since productive capacity was not large enough to serve the rollout without driving prices higher among competing projects.

End demand from consumers is starting weaken now that COVID-19 stimulus savings are gone and credit card debts are rising in the face of significantly higher interest rates. A tapped out working-class consumer impacts the return potential for new business investment.

The federal government debt load is unsustainable—higher rates making interest costs a larger burden against tax receipts. The federal budget deficit is running around 6.5% of GDP. The government is overspending to deal with interest on debt, military expenditures, and social entitlements (social security/medicare) and safety nets (medicaid, etc.). Hence, DOGE is trying to remedy the situation, but not in a democratic way. Since 2010, the U.S. has run some of the largest deficits since the great depression and WWII.

But here is the challenge with DOGE: government spending cuts lead to less corporate profits. Only higher business investment can make up the difference. But why would businesses invest if consumers are tapped out? The extension of the Trump tax cuts won’t stimulate the economy, but they require government spending to be reduced for other social services, which dampens economic activity and hurts lower-income Americans.

So where does this lead?

Why This Leads to a Productivity War

The government will cut spending and raise tariffs, why? The spending cuts try to avoid a fiscal crisis led by unsustainable government borrowing (see Ray Dalio, How Countries Go Broke). EU countries have generally tried to keep the annual deficit-to-GDP running around the 3% level. The tariffs attempt to cut off U.S. purchases of cheap foreign goods and services. This tries to force U.S. and foreign firms to relocate infrastructure into the United States, thus ramping up net business investment to offset the government spending cuts.

But end demand is weak, employment is stalling, and relocating jobs/factories to the U.S. may result in higher-cost goods and services, which is inflationary if purchases continue and deflationary if the higher prices scare off demand entirely. The return on investment looks suspect unless the government hands out the money for building the infrastructure, which is partly what Biden started doing with the CHIPS Act and the Inflation Reduction Act, hence the continued inflation.

Trump may decide he needs to engineer a recession to lower interest rates (to impact investment borrowing and housing mobility/affordability) and weaken the U.S. dollar. If he raises tariffs without weakening the U.S. economy, then other countries will depreciate their currencies to try to maintain global market share for export goods. Trump can’t let that happen. The tariffs have to be ridiculously high to cut off supply options and force businesses to produce in the U.S.

But businesses have two ways to increase profits: invest for more revenue growth (new stores, new plants, etc.) or cut costs to drive productivity. BOOM! So, artificial intelligence (AI) is both the investment and the productivity tool.

Trump will claim that AI-driven productivity gains are a sign of American economic strength—but in reality, this will concentrate wealth further upward.

Corporations will compete to eliminate jobs, not create them.

Wall Street will reward AI-based cost-cutting over job creation.

Workers will be left behind as automation accelerates in professional work beyond manufacturing.

Instead of economic expansion, we will see a corporate productivity arms race, where companies slash costs to increase efficiency, while everyday Americans face wage stagnation and job displacement. The tech giants will invest to win the AI productivity arms race, but other businesses will buy AI agents to cut workforce staffing. The gains from the AI productivity increase will flow to shareholders of businesses that deploy AI to replace knowledge workers and to the owners of the techno-feudal platforms delivering AI-as-a-Service (AaaS).

With tariffs coming like a wrecking ball to reduce the demand for foreign goods and services and AI displacing while-collar workers, investors will milk existing business moats rather than bet on new stuff. Large businesses that might go bankrupt trying to reposition supply chains will seek exemptions, and get them. Cash flow negative companies will struggle. Some will go under.

Deflation will start to swamp the system as the Trump recession takes hold while the productivity war intensifies.

Profits & Productivity by the Numbers

What does an economy of, by, and for the affluent look like?

High-end homes, high-end cars, high-end travel, and high-end services seem to multiply while middle-class and working-class living gets squeezed by inflation for survival goods (think apartment rents, healthcare, groceries, transportation, and education). The U.S. auto market has already recently determined that making cars for the bottom half of the economic ladder doesn’t really produce enough return on investment. Now even high-income earners can’t stomach the price of new vehicles.2 (See video on new car market3).

The chart below shows the share of consumer spending by different household income cohorts. The top 10% of households now account for 50% of consumer spending, the next 30% richest households account for just over 30% of spending, and the bottom 60% of households account for less than 20% of all spending, a multi-decade low. This is techno-feudalism in the making as digital rents accumulate.

Next, let’s compare corporate profits and government debt growth to show the parallel spike. The first graph shows the rise in corporate profits with particular bursts after 2000, driven by financial gains on the housing boom and low interest rates, and the spike after the pandemic. The second graph show the growing federal debt, due to widening deficits, with particular acceleration after the great housing bust (2009) and the pandemic (2020) to bolster the economy. The Fed allowed low rates and quantitative easing (money expansion) to drive wealth inequality to record levels.

And how did corporate profit margins fare during this time period? From 2001 to 2021, S&P 500 (index of large global companies) profit margins more than doubled from 6% to over 12%.4 The reasons include tax policy changes, global supply-chain optimization (neoliberalism), tech productivity gains flowing to capital and not labor, market consolidation (M&A to the moon!), pricing power above inflation, monetary policy with low interest rates, and shareholder-focused corporate strategies.

To drive home the point that productivity gains flowed to shareholders and not wage-earnings, we look at this chart below from the Economic Policy Institute. The vast wealth creation accruing to the top 1% or top 10% is a testament to the gap in the graph below.

And this next chart show wages and salaries in the United States as a share of GDP. The trend has been falling since 1970 and seems to be hovering near 42%. AI is likely to test that boundary and send the wage share of GDP lower.

So, the next productivity/profit margin expansion choice for corporate America is a no-brainer. Large companies will invest in AI—not to give consumers some fun image-creating tools and chatbots, but to give corporations the power to replace expensive white-collar knowledge workers. The core functions of professional-managerial class (PMC) jobs must be displaced and enhanced by algorithms: behavioral engineering (marketing science) and labor productivity consulting (human resource configuration).

Corporate Techno-Feudalism by the Graphs

How dramatic has this shift to corporate techno-feudalism been in the world of business? Let’s view it from the lens of the largest 500 companies listed on U.S. stock exchanges. The data we need focuses on The Magnificent 7 (Mag 7) as proxy for how the world changed when the techno-feudal platforms came into strength. There is a mergers and acquisitions (M&A) strategy and story that supports this techno-feudal platform consolidation and domination. Clearly, the government didn’t interfere with the strategy. As such, U.S. antitrust policy needs an overhaul.

The economic classes of the neoclassical era taught that excess profits would bring numerous competitors into a market. This competition would squeeze profits and serve to protect consumers. Alas, technology platforms exhibit first-mover moats and network “winner-take-all” characteristics. Hence, the digital feudal lords earn rents above and beyond normal profit margins. And new entrants get bought and brought into the fold, reducing competition and cementing platform dominance.5

The Magnificent 7 companies are Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook/Instagram), Nvidia (AI semiconductor chips), and Tesla. Each has created enormous value from platform technology that is harvesting user data, cannibalizing older business offerings, and using cloud compute power to change the world. The rise of AI is proliferating through these platforms and the data centers that many of them operate.

We will look at five graphs to explain the consolidated power of the techno-feudal platforms. 1) Revenue growth over 12 years. 2) Equity index market share growth over 12 years. 3) Company valuation differences (the Mag 7 vs. the other 493). 4) Wealth creation over 12 years. 5) Stock appreciation since ChatGPT came on the scene.

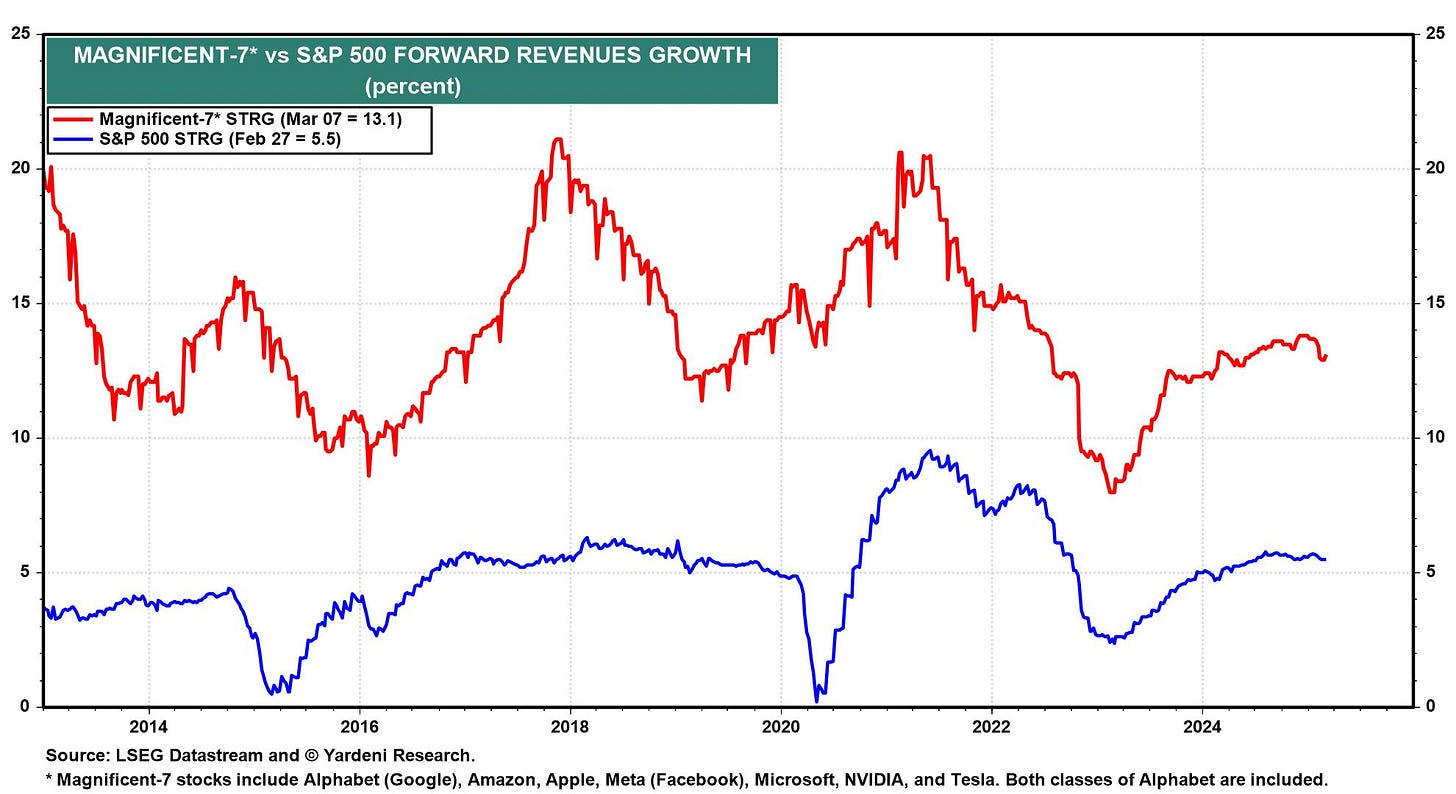

1) Revenue growth over 12 years. Notice how the blue line for the 500 largest companies shows revenue growth around 5.5%. This matches the nominal growth of the economy (3% real GDP plus 2.5% inflation). The revenue growth for the Mag 7 has been 2 to 4 times higher at 10% to 20%.

2) Equity index market share growth over 12 years. The Mag 7 went from 6% of the market value of the 500 largest companies to 30% of the value (493 are now 70%, down from 94%). The Mag 7 grew from producing 7% of the earnings to 22% of the total earnings. And revenue share grew from 4% to 11.5%. It’s been an astonishing growth curve.

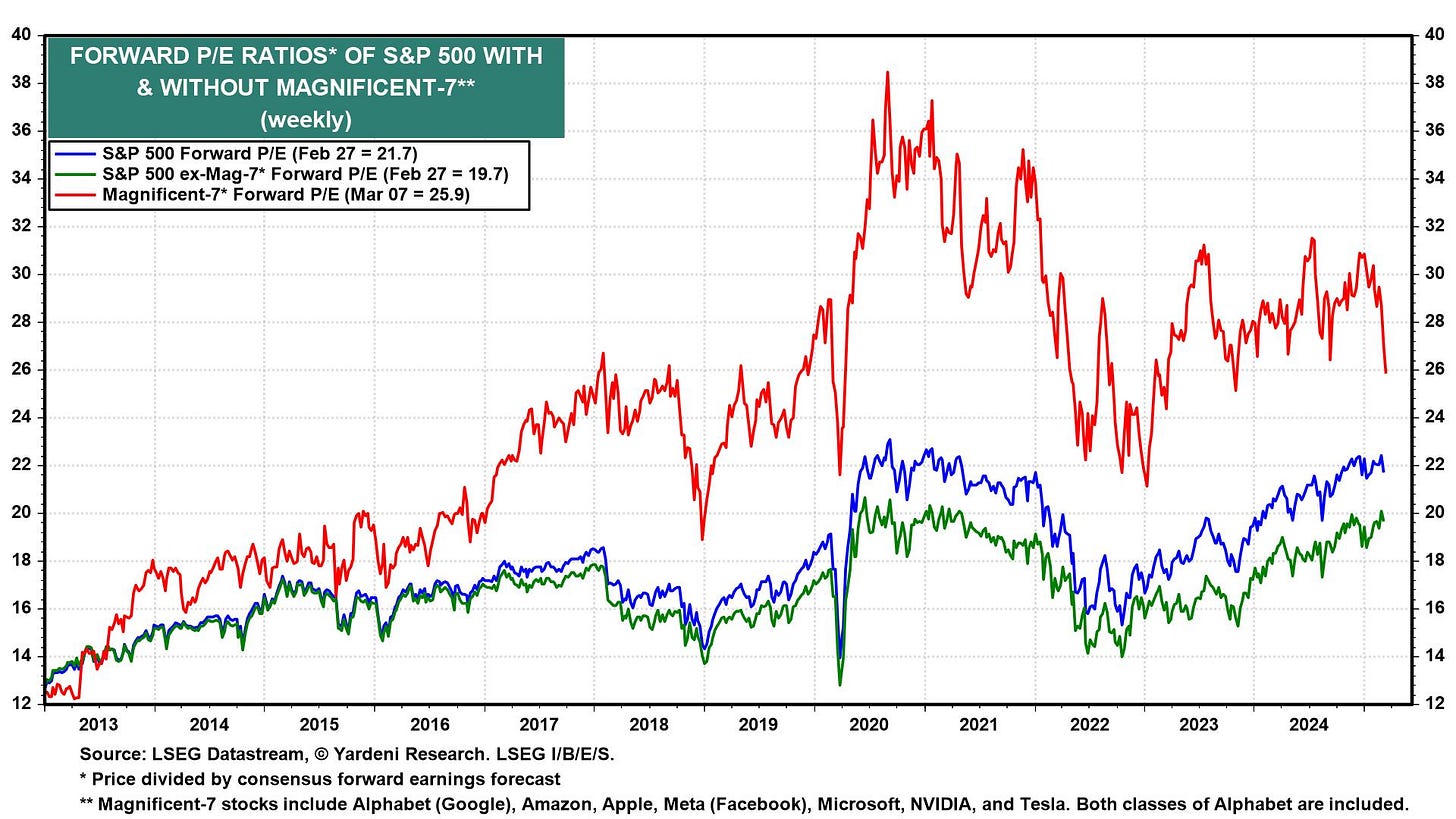

3) Company valuation differences (the Mag 7 vs. the other 493). Pricing companies as a multiple of earnings is a simple comparison tool. Companies that have higher profit margins, better returns on reinvestment, and high sales growth tend to have higher earnings multiples. The Mag 7 (red line below) have generally been valued 30% to 75% higher than the other 493 largest companies (green line below). (22 vs. 17 P/E in 2017, and 30 vs. 17 P/E in 2023 once ChatGPT came on the scene).

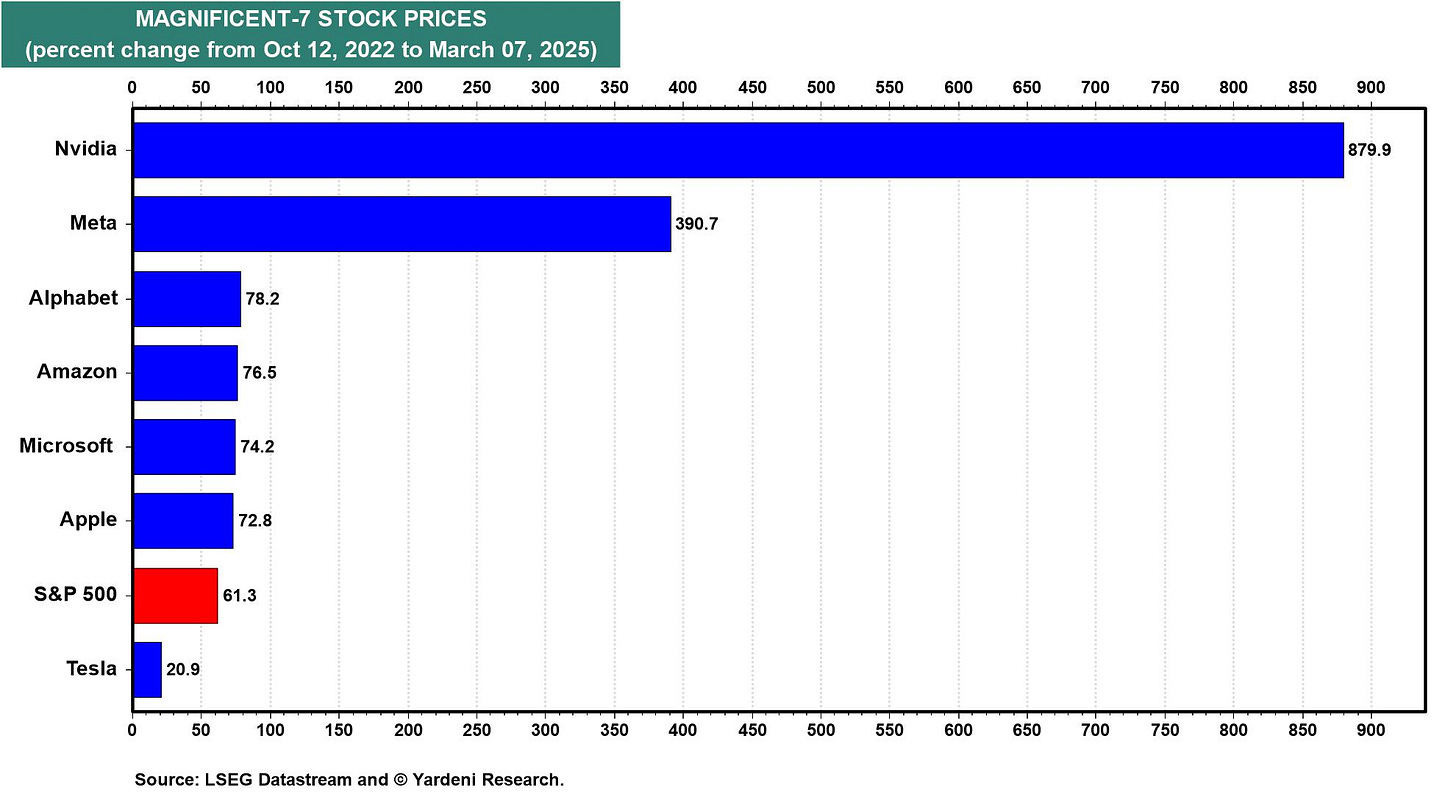

4) Wealth creation over 12 years. The Mag 7 have grown wealth about 1,300% over 12 years. The other 493 companies have increased in value about 200%. The gap is staggering.

5) Stock appreciation since ChatGPT came on the scene. While ChatGPT went live near the end of November 2022, this chart captures the anticipation of the event (about 6 weeks earlier) to current. Nvidia, the maker of the chips that power the compute function needed for AI, has grown 880%. Meta has increased 390%. The other key tech stalwarts have grown similarly (between 72% and 78%). Tesla has lagged because it’s market value expanded so rapidly prior to the start of this comparison.

From the graphs of the Mag 7 cohort, we see how consolidating the power of technology platforms that harvest user data has been enormously profitable to the owners of these tech systems. The power of the network depends on users. Sophisticated algorithms can amplify voices, silence voices, manipulate behavior, and feed cultural narratives to the masses. The rise of social media has impacted political discourse. The eruption of AI is about bleed into the political sphere in unpredictable ways.

III. The Political Realignment and the Future of Work

As techno-feudalism tightens its grip, the political landscape will continue to fracture and realign. The disruptions to white-collar labor, combined with Trump’s economic missteps, could accelerate new political coalitions around economic justice.

The Collapse of the Professional Class Loyalty to the Democrats

For decades, the Democratic Party has been the party of educated professionals. But as AI disrupts the economic security of white-collar workers, this coalition could begin to unravel.

Laid-off professionals may abandon the Democratic Party if they feel abandoned in favor of corporate-friendly tech policies.

A potential “AI populism” could emerge—where displaced workers demand government intervention against automation-driven layoffs.

The GOP’s AI Nationalism Could Backfire

Trump’s economic nationalism will likely include some protectionist AI policies, such as limiting foreign AI firms or forcing tech companies to keep AI development “American.” But this will not solve the core problem:

Trump’s corporate alliances will prioritize stock buybacks and CEO profits, not workers.

AI-driven automation will accelerate job losses in traditional conservative strongholds, such as customer service, logistics, and retail.

Small business owners—once GOP loyalists—will feel squeezed by AI-driven monopolization.

The Rise of Independent Movements Focused on Economic Security

The breakdown of the traditional Democrat vs. Republican divide creates an opening for independent populist movements to propose bold solutions, such as:

A universal AI dividend—taxing AI productivity to fund income support for displaced workers.

Stronger antitrust action against Big Tech, preventing AI monopolies from dominating key industries.

Publicly owned AI infrastructure, ensuring AI-driven productivity benefits society rather than just shareholders.

The future of American political ideology will be shaped by how the country responds to AI-driven labor disruption—and whether the political class addresses it before the public turns against them entirely.

IV. Conclusion: The AI Reckoning and the Future of the American Economy

Techno-feudalism is restructuring American labor markets in real-time, with AI-driven automation serving as the ultimate disruptor. The white-collar professional-managerial class, once thought to be secure, is now on the front lines of job displacement.

Meanwhile, Trump’s economic strategy will likely exacerbate productivity-based job destruction, enriching major corporations while leaving everyday workers behind.

Techno-feudalism is not merely restructuring wealth and power—it is fundamentally altering the social contract between workers, capital, and the government. The future is not just about who owns what, but who owns the ability to create wealth at all.

The political realignment is accelerating, as voters grapple with the consequences of AI-induced economic turmoil. The question now is whether the emerging political movements—independent, populist, or otherwise—will rise to meet this challenge before it’s too late.

The next essay in this series will explore the political patronage of corporate techno-feudalism—examining how captured Democratic and Republican parties align with Big Tech to score political victories using rosy promises and catchy slogans while undermining democratic governance, political speech, and corporate regulatory frameworks.

Question to readers: do you see corporate techno-feudalism driving significant knowledge worker displacement—why or why not?

Notes:

The Common Sense Papers are an offering by Common Sense 250, which proposes a method to realign the two-party system in the United States with the creation of a new political superstructure that circumvents the current dysfunctional duopoly. The goal is to heal political divisions and reboot the American political system for an effective federal government.

Notes on Corporate Techno-Feudalism and Neoliberalism:

Charts: for many charts in this article, see Yardeni Research at yardeni.com.

For example, see list of Meta acquisitions, now numbering over 100.

Brilliant, sober analysis of what is unfolding Joe.

Joe, YOU are right on the money with this call to action for the populism movement. We must get the resources of our government on the side of the people...and quickly.

That is why I am running for Congress. I invite all to come help me and the United Independents efforts. MaxsentiForCongress.com